Financing Your Education

Easy Ways to Find Funding for Private School or College

by Meredith Pruden

If you’re considering an independent school or college education for your child, you’re likely wondering how you’ll pay for it. The cost of tuition can be discouraging for both parents

and students. However, even though private school and higher education are relatively expensive, the benefits greatly outweigh the costs. Independent schools usually offer more specialized

courses and individualized instruction as well as smaller class sizes, while colleges foster skills such as independence and responsibility and usually allow your child to acquire a higher-paying job than a non-graduate. If

you and your child decide that independent school or college is the best path to take, don’t let cost get in the way. There are many funding

options available to help ensure that your child reaps the benefits of a private or higher education.

Saving and Investing

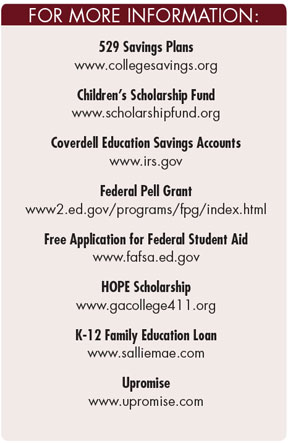

One way to fund your child’s education is through parent and student personal savings and investments. Parents may set aside a certain amount of money each month, years prior to the start of school or college. Any amount helps. The Upromise college rewards program is a subsidiary of Sallie Mae, the nation’s leading provider of student loans and administrator of college savings plans. Upromise allows members to earn 1 to 25 percent back on purchases

with the company’s numerous business partners, including restaurants, drug stores, grocery stores and more. Those savings are put in their Upromise account. Essentially, everyday spending is turned into money for college, and the program is free. Family and friends can also contribute to the account. Members can choose whether they want to receive a check or invest it directly into a 529 tax-free savings plan, a popular method for saving for college.

One way to fund your child’s education is through parent and student personal savings and investments. Parents may set aside a certain amount of money each month, years prior to the start of school or college. Any amount helps. The Upromise college rewards program is a subsidiary of Sallie Mae, the nation’s leading provider of student loans and administrator of college savings plans. Upromise allows members to earn 1 to 25 percent back on purchases

with the company’s numerous business partners, including restaurants, drug stores, grocery stores and more. Those savings are put in their Upromise account. Essentially, everyday spending is turned into money for college, and the program is free. Family and friends can also contribute to the account. Members can choose whether they want to receive a check or invest it directly into a 529 tax-free savings plan, a popular method for saving for college.There are actually two types of 529 savings plans, also called “qualified tuition plans.” One is the pre-paid tuition plan, which allows those saving for college to pay for tuition credits, and sometimes room and board, at participating colleges in advance. This method often comes with state residency requirements. The second type allows college savers to open accounts in which the saved funds can be allocated for any college tuition. Earnings in 529 plans are not subject to federal tax, and in many cases state tax, if used for eligible college expenses such as tuition or room and board. At least one 529 plan is available in each of the 50 states save Tennessee, according to the U.S. Securities and Exchange Commission.

An additional savings plan that can be used for private and higher education is a Coverdell Education Savings Account (ESA), a trust or custodial account that can be established for any beneficiary under the age of 18 or any special-needs beneficiary. Contributions are not tax-deductible, but they are tax-free if distributions from the account do not exceed the beneficiary’s qualified education expenses at an eligible college or school. To open a Coverdell ESA, your modified adjusted gross income must be less than $110,000, or $220,000 if filing a joint return.

Loans, Grants, and Scholarships

Another way to fund college or private education is through student and parent borrowing. Much like universities, many independent schools utilize financial aid to cover tuition, including multiple-student discounts (for those enrolling more than one child) and payment plans. Many independent schools in the Atlanta area, such as Mount Vernon Presbyterian School in Sandy Springs, offer needs-based financial aid through the School and Student Service for Financial Aid (SSS), a service of the National Association of Independent Schools.

Another way to fund college or private education is through student and parent borrowing. Much like universities, many independent schools utilize financial aid to cover tuition, including multiple-student discounts (for those enrolling more than one child) and payment plans. Many independent schools in the Atlanta area, such as Mount Vernon Presbyterian School in Sandy Springs, offer needs-based financial aid through the School and Student Service for Financial Aid (SSS), a service of the National Association of Independent Schools.In addition, Sallie Mae offers the K-12 Family Education Loan, which typically carries low interest rates, to parents or other creditworthy family members of children attending private elementary, middle, or high schools.

For college, federal government loans are available to both students and their parents, and often come at low interest rates with long-term repayment schedules that may not begin until after graduation. College financial aid offices can assist with acquiring federal student loans, but the process usually requires the completion of a Free Application for Federal Student Aid (FAFSA). Filing this application helps ensure that you and your child will receive all the types of federal funds for which you are eligible.

Grants and scholarships, which typically do not have to be repaid, are another source for funding private and post-secondary education.

For both universities and many independent schools, needs- and merit-based scholarships are available. A popular needs-based grant for colleges is the Federal Pell Grant, obtained by filing a FAFSA and given to low-income undergraduate and certain post-baccalaureate students.

The Children’s Scholarship Fund provides aid to low-income families for use at a private school of their choice. There are numerous scholarship options for college, but perhaps the most well-known (and utilized) merit-based scholarship program in Georgia is the HOPE (Helping Outstanding Pupils Educationally) Scholarship, funded by the Georgia Lottery. The HOPE Scholarship rewards students with financial

assistance in degree, diploma and certificate programs at eligible Georgia public and private colleges and universities and public technical colleges. Scholarships are typically offered directly

from individual schools and colleges.

The Children’s Scholarship Fund provides aid to low-income families for use at a private school of their choice. There are numerous scholarship options for college, but perhaps the most well-known (and utilized) merit-based scholarship program in Georgia is the HOPE (Helping Outstanding Pupils Educationally) Scholarship, funded by the Georgia Lottery. The HOPE Scholarship rewards students with financial

assistance in degree, diploma and certificate programs at eligible Georgia public and private colleges and universities and public technical colleges. Scholarships are typically offered directly

from individual schools and colleges.With a bit of research and planning, you can help ensure that a lofty price tag doesn’t prevent your child from reaching his or her potential. And you’ll see the return on your investment for years to come.